Support

Planned Giving

Gifts from Retirement Plans

Your retirement-plan benefits are very likely a significant portion of your net worth. And because of special tax considerations, they could make an excellent choice for funding a charitable gift.

Retirement-plan benefits include assets held in individual retirement accounts (IRAs), 401(k) plans, profit-sharing plans, Keogh plans, and 403(b) plans.

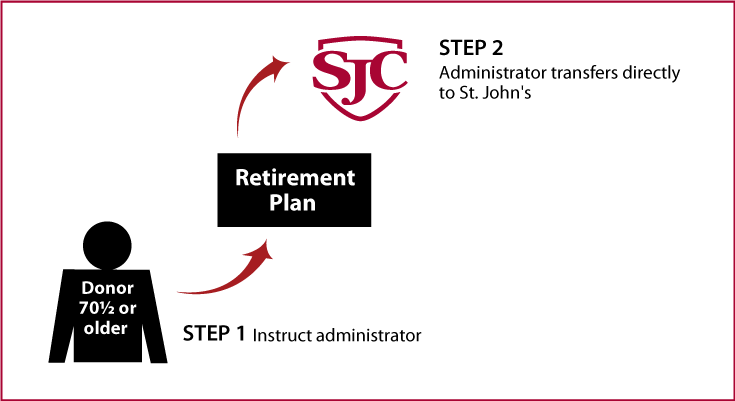

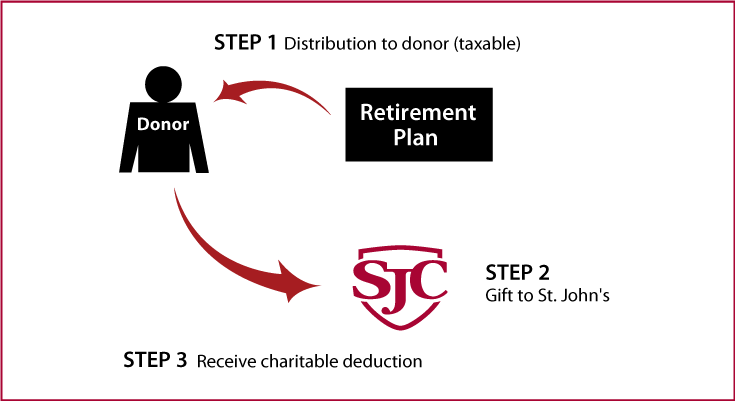

Lifetime Gifts  Click to See Diagram |

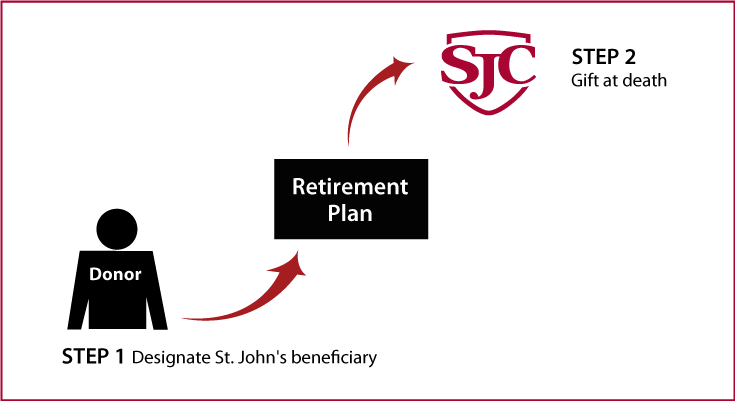

Estate Gifts  Click to See Diagram |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

For More Information

For more information about making an estate gift or the De La Salle Legacy Society, please contact Associate Director of Advancement Tom Veith at 202-363-2316, or tveith@stjohnschs.org.